States are required to withhold 25% for federal taxes.

States are required to withhold 25% for federal taxes.

States are required to withhold 25% for federal taxes.

You'll pay income taxes on sale price, minus the cost of the item, advertising costs and any other costs involved in selling the item.

You pay tax on your profit. If you are doing this for a business, you want to report this on a Schedule C, which will allow you to report the revenue and deduct cost of goods and associated costs. The net carries into the calculation of your taxable income.

If this is a one-time thing, don't … Read more

You pay tax on your profit. If you are doing this for a business, you want to report this on a Schedule C, which will allow you to report the revenue and deduct cost of goods and associated costs. The net carries into the calculation of your taxable income.

If this is a one-time thing, don't … Read more

You pay tax on your profit. If you are doing this for a business, you want to report this on a Schedule C, which will allow you to report the revenue and deduct cost of goods and associated costs. The net carries into the calculation of your taxable income.

If this is a one-time thing, don't … Read more

You'll pay income taxes on sale price, minus the cost of the item, advertising costs and any other costs involved in selling the item.

You'll pay income taxes on sale price, minus the cost of the item, advertising costs and any other costs involved in selling the item.

You'll pay income taxes on sale price, minus the cost of the item, advertising costs and any other costs involved in selling the item.

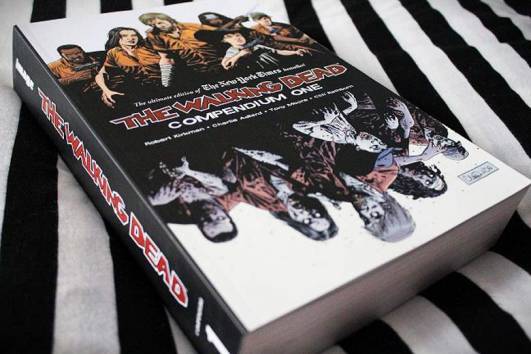

The Walking Dead Compendium, Volume 1

by Robert Kirkman